RESOURCES ⇢ B2G

Government Contractor Relationships: How to Measure & Grow for Success

Using your relationships to determine your PWin in government contracting can be full of surprises if you’re not tracking your relationship quality.

Your multi-year contract is up for renewal, and you believe your competitors would love to be your position.

Your team is convinced the customer loves them and your solution in gate reviews long before the recompete RFP dropped.

Your PWin (probability of win) was sky high as you excitedly called into your meeting.

The award is announced…and it’s not you. A range of emotions hit you as the call wraps up.

What went wrong?

THE MISSING PIECE

Losing any contract can be incredibly frustrating, especially if you were convinced you would win. And unfortunately, it can have devastating consequences.

When this happens, leaders immediately wonder:

“How could my team let a competitor steal it right from under our noses? How could they not know what the customer wanted, when they were right in the trenches with them?”

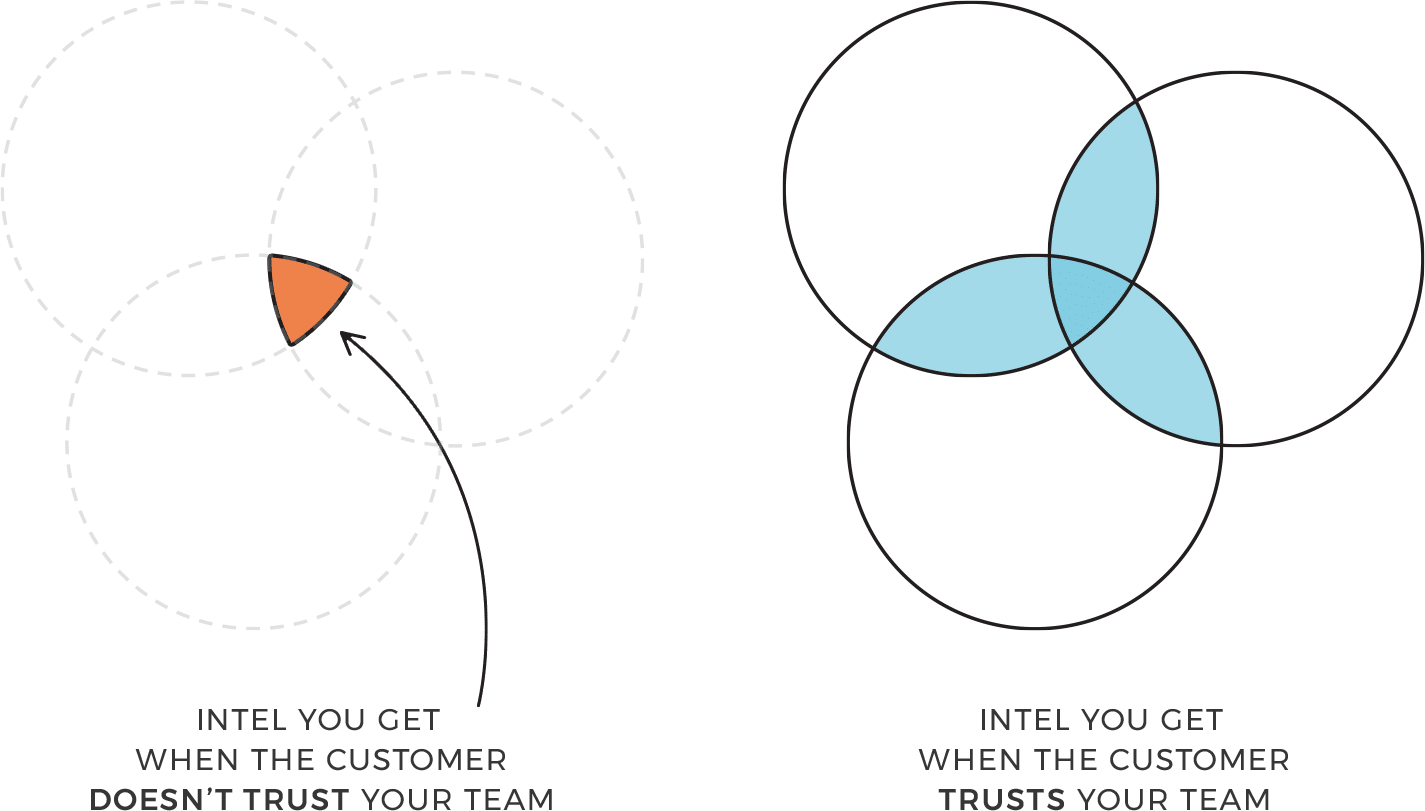

The answer is simple: your team overestimated their relationships.

This is a common story we hear from leaders often, as teams frequently lead their leadership to believe they simply have wonderful relationships with customers and stakeholders.

Reality rarely matches this self-assessment, and if you’re not tracking any KPI associated with relationship quality, there is no way for you to validate their claims.

Worse, now it’s on you to plug the $50M hole in your forecast.

You live for predictable, organic growth—but too often, you’re blindsided by losses like this you never saw coming.

The missing piece?

Usually, your team’s disconnect is driven by 2 factors: culture and lack of skills.

When your team is more focused on your internal processes than the customer’s needs and drivers, large disconnects can take place opening up new opportunities for your competitors.

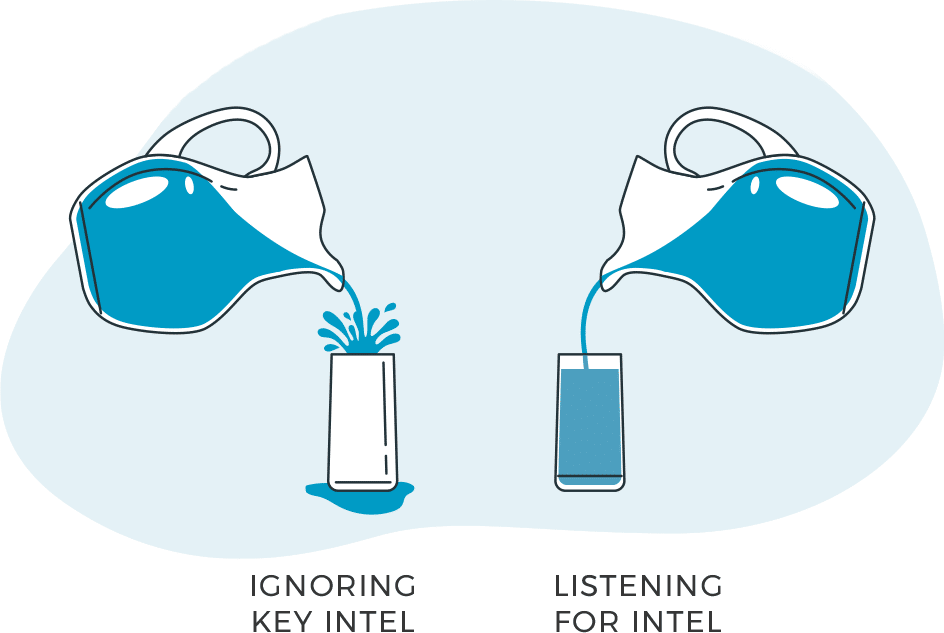

Even if you maintain a (truly) customer-centric culture, if your team doesn’t have the skills, knowledge and confidence to ask the right questions, you’ll get nowhere fast.

Knowing where you really stand with customers is essential to move past assumptions and discover the real discriminators to compete and win.

Does your team miss the critical but subtle clues?

Customer Relationship Score (CRS) is the one KPI that can save your team from guessing and hand you the win. In this article, we’ll show you how.

WHY 'SURE THINGS' FAIL

Melissa is a sharp and determined CGO who called us last year for help. She shared her team just lost a must-win recompete they’d banked on and thought was a “sure thing.”

They were completely blindsided.

A few weeks later, she learned the winning team had dug deeper, catching shifts in needs and priorities Melissa’s onsite PM, SME, and even BD team missed.

They were operating on assumptions instead of deep customer intel and thought the customer must be pleased, as there have been no complaints.

But while they held back on the difficult questions, their competitors were hard at work gathering the customer’s real requirements and motives. This mistake cost Melissa millions.

She was concerned for her team’s future, and felt frustrated she lost despite following what she thought were best practices.

Melissa mentioned she was not looking forward to the late nights she would have to spend with the team to try to make up for this loss, and worse, she wasn’t sure how to prevent this in the future. How could she even attempt to get her team to focus on what really mattered?

Sound familiar?

That’s the sting of weak CRS—your team won’t see the disconnect until the debrief.

3 RED FLAGS TO WATCH FOR

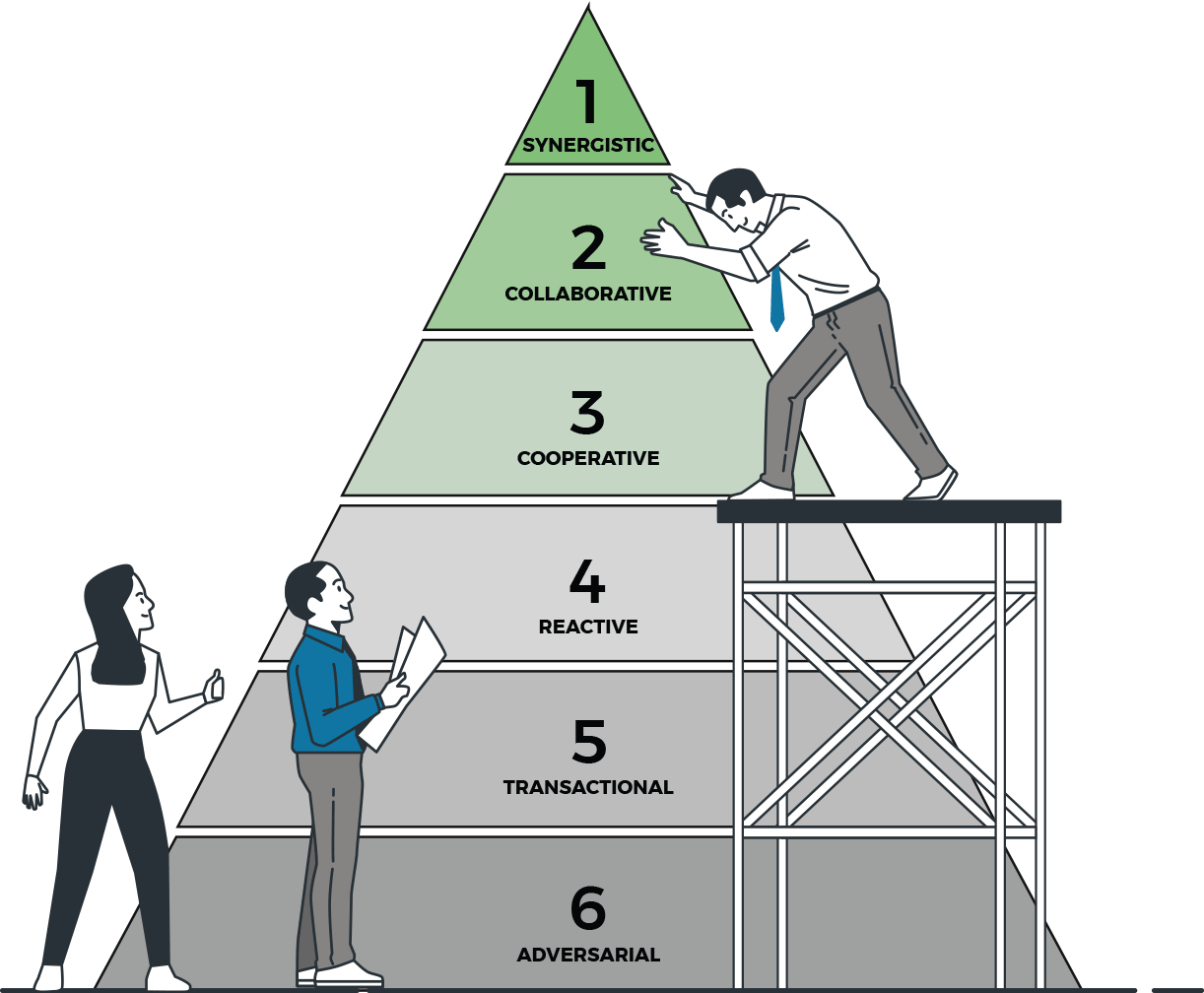

Teams often mistake casual chit-chat for good relationship quality. But being liked isn’t the same as being trusted; trust comes from connecting, understanding, and providing value.

Have you recently experienced any of the following?

- Proposals lack clear differentiators because your team didn’t understand the competition and customer’s needs well enough to know what set your solution apart.

- Surprise losses to competitors: everything appeared great until suddenly it didn’t.

- Unnoticed changes in acquisition strategies until it was too late.

All of these likely resulted in a loss for you or someone you know, so you understand the pain of removing millions in forecast revenue in cases like this.

WHY TRADITIONAL KPIS ARE FAILING YOU

Traditional KPIs like win rates or deal volume tell you what’s already happened—they’re lagging indicators, snapshots of the past.

CRS is a leading indicator, revealing in real-time whether your team’s engagement is laying the groundwork for future wins and on contract growth.

By measuring trust and strategic fit before the deal closes, CRS shows you if you’re on the right path or if your team is paving the way for the competition.

82% of government decision-makers say strong relationships are a key factor in awarding contracts,³ yet only 28% provide formal training in areas like relationship building and emotional intelligence. ⁴

¹ SALESFORCE: STATE OF SALES | ² APMP BENCHMARKING STUDY

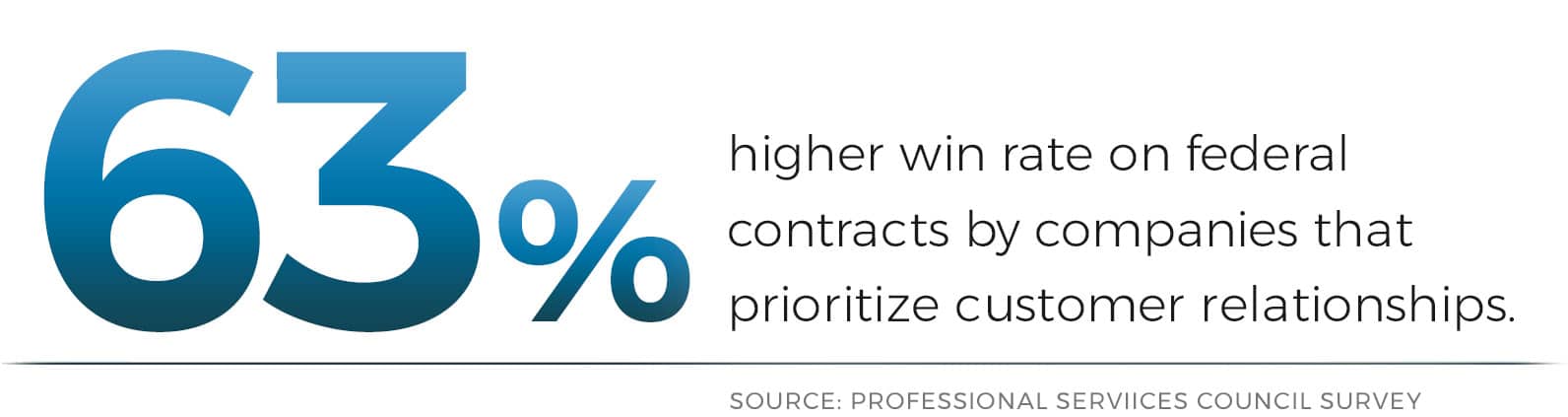

Top-performing companies don’t just track outcomes; they prioritize customer relationships and measure their strength to predict and shape them.

Firms that embed CRS into their approach see stronger partnerships and higher PWin, proving it’s not just a feel-good metric—it’s a growth driver.

CRS is a critical metric in your relationship management strategy. Remember: you can’t improve what you can’t measure.

CEOs who prioritize customer-centricity are 60% more likely to outperform their competition. (Deloitte)

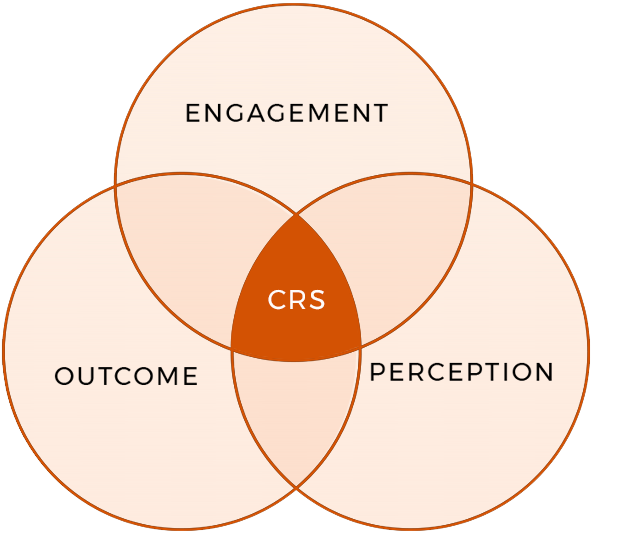

WHAT IS CRS?

At its core, the Customer Relationship Score (CRS) reflects the strength of the partnership: how much customers see your team as a vital ally focused on their success, and not just another vendor.

❌ It doesn’t measure how often your team shares in casual conversations.

✅ It’s a deeper, more strategic measure of how much the customer values your partnership.

Customer Relationship Score (CRS)

A measure of trust, emotional connection, and strategic alignment between employees and customers, assessed by those with customer access, like business developers or delivery teams, to boost win probability (PWin), drive organic growth and guide deeper relationships.

Unlike traditional metrics that focus on transactional satisfaction, CRS provides a deeper view of relationship quality and practical steps to take to improve factors driving loyalty, retention, and long-term growth.

Traditional KPIs (like win rates) are lagging indicators. CRS is different.

It’s a customer engagement metric, serving as a leading indicator that tells you whether you’re doing the right things to impact future wins. This is why the best-performing companies focus on CRS as a leading indicator driving CRM strategies—and it works.

Organizations are 80% more likely to win if their teams excel at customer engagement¹ and strong engagement strategies can increase their annual revenue by up to 23%².

¹ Deltek Federal Procurement Success | ² Aberdeen Group

TANGIBLE BENEFITS OF A HIGH CRS

When a high Customer Relationship Score (CRS) exists, there is no need for assumptions as you are aligned with the customer.

Your team will more easily:

- Uncover customer needs and priorities long before the RFP drops.

- Identify all the stakeholders, not just the obvious ones.

- Continuously refine and vet solutions based on customer input.

- Build trust that leads to repeat wins and strategic expansions.

HOW TO INCORPORATE CRS

Before tracking CRS, Melissa did not truly know where her team stood with their customers. She partnered with Hi-Q Group to address this and integrated CRS into the processes and culture.

Here’s the framework we used (and you can too):

-

- Define CRS: Establish clear criteria for defining your own CRS or contact us to learn more. For example, a great relationship is one where your team understands the customer’s top strategic objectives, funding constraints, emerging needs, and stakeholder priorities. In a negative relationship, your team is limited to surface-level discussions, lacks stakeholder engagement, or misunderstands evolving needs.

- Determine Risks & Opportunities: Evaluate existing critical customer relationships using your CRS criteria. Have customer-facing employees (e.g., business developers, SMEs, PMs, sales) score current trust, emotional connection, and alignment levels per account to identify gaps where your team needs to focus their efforts. Our clients leverage the Hi-Q CRS Assessment to accurately report their current standings.

Businesses need to constantly evaluate how they do business with people. [This training] will create a team enabled to build deep embedded partnerships that provide the business long term, sustainable and desirable results across the organization.

- Train Your Team: Give all customer-facing team members the skills to engage customers, develop relationships, gather intelligence, and share it internally. These critical skills give your team the tools and confidence they need to shift their conversations and results.

- Integrate CRS into Processes: Embed CRS into account reviews, pipeline meetings, gate decisions, and capture strategies. When pursuing an account or opportunity, use CRS results to identify gaps and assign those with the best CRS to help.

- Align CRS with Growth Goals: To ensure CRS drives organizational success, link it directly to growth targets. Set clear goals—such as raising average CRS scores from 3.5 to 4.2 in 6 months—and track how high-CRS accounts correlate with measurable wins, integrating it into regular strategy reviews.

- Foster a Customer-Centric Culture: Many companies claim to focus on the customer, but despite what the posters in the break room champion, most organizations focus more on process than understanding the customer.

Building a truly customer-centric culture takes time, but by leveraging a measurement like CRS, you can take steps to prioritize customer understanding in your organization. Celebrate teams who excel at trust and alignment, like sharing stories of a recent success.

Recognize high CRS scores in performance reviews and train managers to coach these skills, embedding a mindset where strong connections are seen as the key to winning business.

RECOMMENDED GUIDE

CRS: YOUR COMPETITIVE ADVANTAGE

High CRS ensures you never have to guess where you stand with a customer.

Instead of waiting for disappointing debriefs, you’ll have the tools to continually assess your relationship and intelligence quality.

This is how you outmaneuver competitors and ensure sustainable organic growth.

measure what matters

Winning goes beyond friendly chats and surface-level intelligence.

CRS is a differentiator and growth accelerator… it’s also the missing KPI on most dashboards. If you are tired of losing contracts and playing guessing games, it’s time to shift the focus.

Ask yourself:

- Do we understand our customers’ priorities and emerging needs?

- Are we measuring the real strength of our customer relationships?

- Do we know that good relationships go far beyond a friendly chat?

- Are we engaging with all key stakeholders or just the ones we are comfortable with?

Stop guessing and start winning.

Add CRS to your dashboard. Define it. Measure it. Act on it. When you know your customer better than anyone else, you don’t just compete—you win.

As a defense industry contractor and business owner with over 20 years of experience, I can confidently say that this is the most impactful training I’ve ever attended for building and improving customer relationships.

TAKE ACTION:

You’ve seen the symptoms of poor customer engagement and the missed opportunities. Now, it’s time to get serious about transforming how your organization approaches customer relationships.

Schedule a confidential 30-minute consultation with our growth specialist to explore how adopting CRS could dramatically shift your results.

learn more:

FREQUENTLY ASKED QUESTIONS

WHAT IS THE GOVERNMENT RELATIONSHIP?

A government relationship is the strategic connection between a contractor and state and federal agencies, built on trust, open communication, and shared objectives.

In federal contracting, these relationships often involve a direct collaboration with agency stakeholders, such as program managers or procurement officers.

The Customer Relationship Score (CRS), developed by Hi-Q Group, measures this relationship quality by assessing trust, emotional connection, and alignment, providing a clear view of partnership strength. Unlike traditional metrics like Net Promoter Score (NPS), which focus on transactional feedback, CRS offers a deeper understanding of how well contractors meet agency needs and drive modern innovations, ensuring stronger ties in complex B2G settings.

WHAT IS an example of a GOVERNMENT RELATIONSHIP?

In federal contracting, a contractor might partner with the Department of Defense to provide cybersecurity services, regularly engaging with agency leaders to align solutions with mission priorities and ensure smooth project delivery. This relationship, built on trust and strategic alignment, helps secure renewals and new opportunities by creating opportunities for collaboration and alignment, not focusing on meeting checklists.

These relationships are crucial for winning government contracts, as they enable contractors to anticipate needs and tailor proposals, enhancing their competitive edge in federal procurement.

WHY IS IT IMPORTANT TO BUILD GOVERNMENT RELATIONSHIPS?

Building strong government relations is essential for securing federal government contracts and maintaining long-term partnerships in the federal government.

Strong relationships enable contractors to understand agency priorities, navigate compliance issues, and differentiate themselves in competitive government RFPs.

For example, a contractor with deep ties to a federal agency can better anticipate needs, tailoring solutions to align with mission goals. CRS enhances this process by quantifying relationship strength, helping contractors like a capture manager prioritize engagement efforts and build trust that leads to contract wins.

Without relationships, even the best proposals risk falling short in the competitive federal landscape.

WHY ARE RELATIONSHIPS IMPORTANT IN FEDERAL CONTRACTING?

Relationships are the cornerstone of federal contracting, where trust and strategic alignment with federal agencies drive success in complex, high-stakes environments.

In B2G, relationships go beyond friendly interactions—they involve understanding agency challenges, aligning solutions with mission objectives, and fostering collaboration across stakeholders.

Strong relationships increase win rates for government contracts by ensuring contractors are seen as trusted partners, not just vendors.

Customer Relationship Score (CRS) plays a pivotal role by allowing contractors to measure trust and alignment, enabling teams to identify gaps and strengthen partnerships before critical RFP submissions in federal procurement.

WHAT ARE the BEST PRACTICES of BUILDing FEDERAL RELATIONSHIPS?

Effective relationship management in federal contracting involves several best practices tailored to the unique demands of government clients.

First, pro stakeholder management ensures engagement with all key decision-makers, from program officers to technical leads, building trust across the agency. Regular communication, through check-ins or strategic discussions, helps contractors understand evolving needs and align solutions with agency goals.

Transparency and reliability are also critical, as federal agencies value partners who address compliance issues proactively.

The metric Customer Relationship Score (CRS) supports these practices by providing a clear metric to track relationship quality, guiding contractors to focus efforts where they matter most and ensuring alignment with agency priorities.

There are also certifications and certificates for federal relationship skills available at Hi-Q Group.

how can government contractors track relationship quality?

Government contractors can track relationship quality using the Customer Relationship Score (CRS), a metric designed to measure trust, emotional connection, and strategic alignment in B2B and B2G partnerships.

Unlike traditional metrics like NPS or Customer Satisfaction Score (CSAT), which rely on customer surveys, CRS is employee-driven, using Hi-Q Group’s CRS Assessment to evaluate relationships through concise, behavior-focused questions.

Contractors can integrate CRS into their CRM systems, tracking scores individually or across accounts to identify risks (e.g., weak stakeholder ties) or opportunities (e.g., expansion potential).

This systematic approach, applicable at gate reviews or quarterly reviews, ensures contractors stay aligned with federal agency needs, enhancing federal procurement outcomes.

how can government contractors improve relationship skills?

Improving relationship skills is critical for government contractors aiming to build stronger ties with federal agencies.

Hi-Q Group’s federal training programs equip customer-facing teams like business developers, SMEs, program managers and capture managers, with skills like active listening, empathy, and strategic questioning.

These programs foster a data-driven approach, teaching teams to gather actionable intelligence and share it internally to align strategies while tracking their relationship quality.

By embracing transformational leadership through data-driven relationship management, contractors can cultivate a customer-centric culture, ensuring teams prioritize trust and alignment in every interaction.

This approach not only strengthens government relations but also drives success in securing and growing government contracts.

To learn more, check our certifications and certificates for federal relationship skills.

what are the key elements of a successful government relationship in government contracting?

Several critical elements contribute to a successful government relationship in federal contracting:

-

Trust and Transparency: Trust is the foundation of government relations, requiring contractors to demonstrate reliability and openness. By consistently meeting commitments and addressing compliance issues proactively, contractors build credibility with federal agencies. For instance, a contractor might share regular updates on project progress to maintain trust with a local government agency, ensuring confidence in their ability to deliver.

-

Proactive Communication: Effective government relations demand regular, meaningful engagement with government officials. This includes proactive check-ins, strategic discussions, and updates on policy moves that impact agency goals. A capture manager might schedule quarterly reviews with agency stakeholders to discuss emerging needs, ensuring alignment and responsiveness.

-

Alignment with Policy Priorities: Understanding and aligning with the policy priorities of federal agencies is crucial. Contractors must tailor their solutions to address agency-specific challenges, such as cybersecurity or infrastructure needs, as outlined in government RFPs. This alignment demonstrates a commitment to shared goals, strengthening the partnership.

-

Pro Stakeholder Management: Engaging all key stakeholders—program officers, procurement teams, and technical leads—is essential for success. Effective relationship management ensures contractors connect with the right decision-makers, fostering a comprehensive understanding of agency needs. For example, a contractor might use stakeholder mapping to ensure all voices are heard during an RFP response process.

-

Adaptability to Policy Moves: Federal contracting is dynamic, with policy moves and regulatory issues shaping agency priorities. Contractors must stay agile, adjusting their strategies to align with evolving needs, such as new compliance requirements or budget shifts. This adaptability ensures relevance in competitive federal government contracts in government relations.

What Is a Government to Contractor Relationship?

A government to contractor relationship is the formal, regulated partnership between a government agency and a contractor (or independent contractor) hired to provide goods or services, governed by strict compliance guidelines and regulations to ensure transparency and value.

This relationship involves the government as buyer and the contractor as provider, with responsibilities like delivering on contract performance standards during contract activities. Key elements include the contracting process, where the government issues a request for proposal (RFP) and evaluates bids based on evaluation criteria like cost and capability.

Contractors, including subcontractors, must demonstrate skill and initiative to win the contract award, often involving investments in resources for fulfillment. The relationship emphasizes mutual accountability, with ongoing performance evaluation to align with public interests, fostering efficiency in areas like technology development. Contracting agencies oversee this to maintain ethical standards and prevent conflicts.

What Is a Conflict of Interest for Government Contractors?

A conflict of interest for government contractors occurs when a contractor’s personal, financial, or organizational ties impair impartiality in contract activities, potentially influencing decisions in contract performance or the contract award process.

This violates ethical standards and regulations, such as FAR Subpart 9.5, which requires disclosure to avoid bias in the contracting process.

Examples include an independent contractor with ties to subcontractors favoring them in bids or using insider info from contracting agencies for unfair advantage. Conflicts can arise from investments in competitors or family relationships with officials, undermining performance evaluation fairness.

To mitigate, contractors must follow compliance guidelines like OCI plans during the request for proposal stage. Hi-Q Group’s BD training helps navigate these in projects to maintain integrity.