RESOURCES ⇢ B2G

This Fixable Recompete Mistake Can Cost Your Organization Millions

We often receive calls from well-meaning leaders after a recompete loss, and in most cases, they were completely in the dark until it was too late. Here’s why:

Tom was the Program Manager of his organization’s longest-running program.

Like most PMs, his busy days focused on execution, never feeling the need to bring up anything outside of the current scope of work.

He felt he already had a great relationship with his DOD customers. There were never any communication issues. He quickly resolved operation problems, and they often shared jokes or chatted about sports or plans for the weekend.

Tom’s organization had been the incumbent on this program for over 20 years, and there was little doubt in his mind they would retain it.

Although the recompete RFP contained a few surprises…

Tom remained confident, saying, “Don’t worry, we got this—they love us.”

Tom couldn’t have been more wrong.

The award went to a competitor, and while they celebrated their win…

Tom’s organization was in shock.

They were left contemplating what had gone wrong, panicked about how to fill the revenue gap, and worried about having to lay off some of their longest-serving employees.

Sound familiar?

THE HIGH COST OF OVERESTIMATED RELATIONSHIPS

Tom made the error of assuming casual chats and lack of complaints meant he had great customer intimacy and customer understanding.

Why wouldn’t he? His organization didn’t have a standard definition or any objective ways for him to measure customer intimacy, and he never received any relationship training.

So, Tom made assumptions and shared them with his leadership.

Overly optimistic and suffering from confirmation bias, they were happy to believe him!

An often-quoted Bain & Company statistic shows that 80% of executives believe their teams deliver superior customer experience, but only 8% of customers agree.

This 72% gap isn’t just embarrassing—it’s a significant barrier to success that leaders must overcome.

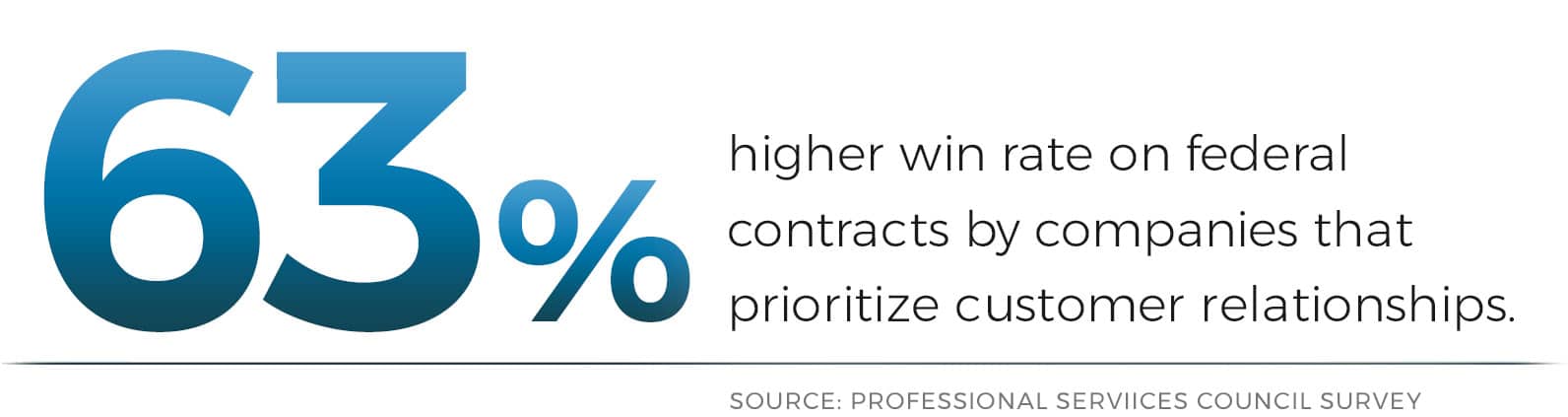

Organizations are 80% more likely to win if their teams excel at customer engagement¹ and strong engagement strategies can increase their annual revenue by up to 23%².

¹ Deltek Federal Procurement Success | ² Aberdeen Group

This problem is so widespread, there is a good chance this silent killer is already in your organization, leaving you to endure the frustration, embarrassment, and anger of explaining to your leadership how a competitor just won your “sure thing.”

THE ROOT OF THE PROBLEM

Why do people overestimate relationship quality?

The answer often lies in human nature and workplace dynamics.

Let’s explore some of the reasons:

- Reluctance to Engage: Employees rationalize avoiding customer interactions. They focus on the negatives rather than how each engagement is an opportunity to help the customer.

- Fear of Negative Perceptions: Concerns about appearing ‘salesy’ or intrusive can limit meaningful engagement.

- Misreading Casual Engagements: Small talk and jokes are mistaken for customer intimacy.

- Confirmation Bias: People seek evidence confirming their belief that the relationship is strong, ignoring negative signals.

- Misinterpreted Courtesy: Professional politeness is often confused with loyalty or satisfaction.

- Lack of Honest Feedback: Customers’ reluctance to provide negative feedback can create a false sense of security.

- Overvaluing Longevity: Long-term relationships are assumed to be strong, even when they may have weakened.

- Past Success Fallacy: Previous achievements are seen as guarantees of future relationship quality without maintaining active engagement and trust-building.

Understanding these factors is crucial for accurately assessing and improving customer relationships.

This avoidant behavior results in limited intel gathering and increases the likelihood that assumptions will be used instead of validated facts in opportunity or gate reviews.

3 PREVENTATIVE MEASURES

Losing a recompete can be the difference between celebrating a successful year and laying off teammates. As a leader, it’s crucial to prevent situations like Tom’s from happening in your organization.

Here are some steps you can take:

1. watch for the warning signs

The front-line team often misses the subtle human clues crucial to relationship success.

These invisible weaknesses in your customer relationships are like a cancer that goes undetected until the damage is irreversible.

As a Leader, you are responsible for recognizing over-estimated relationship symptoms as early as possible. These include:

- Limited Engagement: Your Team never engages the customer outside of formal status or review meetings.

- One-Way Communication: Your Team eagerly provides capability briefings, white papers, demos, and solutions but gets little intelligence in return.

- Limited Account Penetration: Relationships are limited to operational contacts or the same customer stakeholders without more strategic customer engagement.

- Same Intel: Your Team asks similar questions and gets the same intelligence as your competitors, offering your proposal team no competitive discriminators.

Often, when you identify these symptoms, you may already be at risk of losing the opportunity.

82% of government decision-makers say strong relationships are a key factor in awarding contracts,³ yet only 28% provide formal training in areas like relationship building, emotional intelligence, and customer-centric selling. ⁴

³ Salesforce: State of Sales | ⁴ APMP Benchmarking Study

2. Define Relationship Quality and Measure it

You can’t improve what you can’t measure, and you can’t consistently measure something that is poorly defined.

Most organizations don’t have an agreed definition or way to measure customer relationship quality (CRS), leaving this to individual interpretation, unvalidated assumptions, and misinterpretation.

RECOMMENDED GUIDE

Our customers use the Hi-Q Customer Relationship Score (CRS) assessment to overcome this challenge. This 6-level scale standardizes definitions and objectively self-assesses an individual’s customer relationship quality.

The Hi-Q CRS Assessment is valuable for validating your team’s quality assumptions. It also provides a way to track relationship quality at individual, account, and opportunity levels.

Think of this assessment as the “canary in the coal mine” providing the warning needed before it’s too late and this silent killer strikes again.

3. Underestimating the Competition

Overestimating the quality of your customer relationships is risky, but underestimating your competitors’ relationships can double your risk.

Remember: Your competitors will actively work to strengthen customer relationships.

Often in ways you might not see.

Businesses need to constantly evaluate how they do business with people. [This training] will create a team enabled to build deep embedded partnerships that provide the business long term, sustainable and desirable results across the organization.

A sage once said, “If it’s not a must-win for you, it probably is for one of your competitors.”

As a Leader, you must always keep this in mind as you objectively assess the relationship quality of your team and the competitors to ensure you don’t succumb to confirmation bias.

you can’t manage what you don’t measure

Tom’s story is a stark reminder of how relationship quality often separates winners from losers. Don’t let complacency and denial cost your organization millions like Tom’s.

Wouldn’t you prefer to know early if your team has the relationship quality needed to win or who within your organization has the best relationships with a new stakeholder?

By implementing a standardized way to measure your team’s relationship strength, you can develop plans to proactively:

- Engage additional stakeholders.

- Improve customer intimacy with current stakeholders.

- Fix or determine hostile relationships can’t be fixed.

Unchallenged assumptions about relationship strength can silently undermine not just upcoming opportunities but your entire organization.

Remember, Tom thought he had this in the bag because the “customer loved them.” And his leaders had no objective way to measure this.

If they had been using the Hi-Q CRS assessment, they would have seen that Tom’s relationship was, at best, transactional, and he wasn’t as well positioned as he thought.

This might have been enough to stop the silent killer before it struck and to keep their flagship contract. Doing this means you should never have to explain how a competitor just won your “sure thing” opportunity.

TAKE ACTION:

You’ve seen the symptoms of poor customer engagement and the missed opportunities. Now, it’s time to get serious about transforming how your organization approaches customer relationships.

Schedule a confidential 30-minute consultation with our growth specialist to explore how adopting CRS could dramatically shift your results.

learn more:

I frankly did not know what to expect being a PM and not in a traditional BD role. I learned so much that could be applied to all facets of relationships including with my government customer. Really enlightening and I highly recommend for anyone in any role not just BD.

FREQUENTLY ASKED QUESTIONS

WHY DO GOVERNMENT CONTRACTS GO INTO RECOMPETE?

government contracts go into recompete to promote competition, ensure best value for federal investments, and adapt to changing needs like technology updates or budgets. This process allows a government agency to reevaluate incumbent contractors and invite new entrants in a competitive marketplace, fostering innovation and cost savings.

Recompetes also prevent monopolies, encouraging market research to identify better options during the contract lifecycle. For example, a government agency might recompete to address performance gaps or align with new priorities, ultimately supporting long-term partnerships and efficient business operations.

WHAT IS THE RECOMPETE PROCESS?

The recompete process is the method a government agency uses to rebid recompete contracts at the end of their term, starting with recompete preparations like issuing a request for proposal or notice of funding opportunity.

Hi-Q Group advises clients to develop a recompete plan early, including market research to understand evaluation criteria and budgets. The procurement process involves the contracting activity reviewing proposals through competitive bidding, where the contracting officer as the decision maker assesses past performance and contract performance.

Incumbent contractors and new entrants participate in the bidding process, submitting via the contract vehicle if applicable. The bidding process culminates in a contract award, with the program manager overseeing transition for smooth contract growth. This ensures fairness in recompete contracts and supports business development throughout the contract lifecycle.

WHAT DOES RATIFICATION MEAN IN GOVERNMENT CONTRACTING?

Ratification in government contracting means the official approval of an unauthorized commitment by someone with authority, like a contracting officer, to make it legally binding. Hi-Q Group emphasizes that this is a rare procurement process step, used only when the action benefits the government and follows regulations, avoiding risks in business operations.

CAN A GOVERNMENT CONTRACT BE EXTENDED AFTER EXPIRATION?

Yes, a government contract can be extended after expiration through bridge contracts or options exercises, if justified by delays in recompetes or urgent needs. The contracting officer must approve, ensuring compliance to maintain contract performance without disrupting long-term partnerships.

WHAT ARE THE EASIEST GOVERNMENT CONTRACTS TO FULFILL?

The easiest government contracts to fulfill are often small business set-asides like janitorial services, office supplies, or IT support, which have lower barriers and use simple contract vehicles. Hi-Q Group highlights these as ideal for new entrants, requiring minimal market research and offering steady contract growth with less competitive bidding.

WHO CAN BID ON RECOMPETES?

Anyone meeting eligibility, including incumbent contractors, new entrants, and qualified firms, can bid on recompetes. Hi-Q Group recommends preparing a strong recompete plan with past performance data to compete in the bidding process, where the government agency evaluates all via evaluation criteria.

HOW OFTEN DO CONTRACT RECOMPETES HAPPEN?

Contract recompetes happen at the end of a contract’s base period, typically every 3-5 years, depending on the term and contract vehicle. Recompetes can be delayed by extensions or protests, aligning with federal investments cycles to refresh long-term partnerships.

WHAT ARE THE RISKS OF CONTRACT RECOMPETES?

The risks of contract recompetes include loss of revenue for incumbent contractors, increased costs from the bidding process, and disruptions in business operations. There is heightened competition from new entrants in the competitive marketplace, potential protests delaying contract award, and uncertainty in contract performance if the program manager or decision maker favors change. Poor recompete preparations can lead to failed bids, affecting contract growth and long-term partnerships.